Financial AI Agents: Deploy CFO Genius at Scale

August 25, 2025

Modern Financial Intelligence at Scale

Modern financial operations generate 2.5 billion invoices annually. Traditional processing captures 12% of available intelligence from these documents. The remaining 88% contains patterns that determine competitive advantage.

Agentic AI fundamentally changes what we extract from financial documents. Beyond data fields lies a web of intelligence: supplier reliability signals, market pricing trends, operational inefficiencies, compliance gaps, and cash flow optimization opportunities. Each invoice contains approximately 200 intelligence points. Traditional systems capture 20. Agentic systems capture 180+.

Agentic AI fundamentally changes what we extract from financial documents. Beyond data fields lies a web of intelligence: supplier reliability signals, market pricing trends, operational inefficiencies, compliance gaps, and cash flow optimization opportunities. Each invoice contains approximately 200 intelligence points. Traditional systems capture 20. Agentic systems capture 180+.

From Data Extraction to Intelligence Mining

Traditional RPA and OCR tools extract data. Agentic AI extracts intelligence—payment optimization opportunities, pricing anomalies, duplicate services, tax gaps, and consolidation savings. These parallel intelligence streams construct actionable insights: "This vendor's pricing increased 3% above market rate" or "Consolidating these services across departments would save €47,000 annually."

Agentic AI uncovers millions in hidden duplicate subscriptions, catches 10-15% tax rate errors across invoices, and reveals cash flow gaps 30-45 days before they materialize. The compound effect accelerates with scale—after 1,000 invoices, it predicts supplier behaviors; at 10,000, it spots cross-department savings; at 100,000, it benchmarks against industry patterns.

Agentic AI uncovers millions in hidden duplicate subscriptions, catches 10-15% tax rate errors across invoices, and reveals cash flow gaps 30-45 days before they materialize. The compound effect accelerates with scale—after 1,000 invoices, it predicts supplier behaviors; at 10,000, it spots cross-department savings; at 100,000, it benchmarks against industry patterns.

The Compound Intelligence Effect

Financial agents learn and evolve with scale. After processing 1,000 invoices, they predict supplier behaviors. At 10,000, they identify cross-department savings. At 100,000, they benchmark against industry patterns, creating a competitive intelligence advantage that compounds over time.

This isn't about replacing your finance team—it's about amplifying their capabilities 100-fold. Where a CFO sees monthly variances, financial agents reveal causality chains. Where spreadsheets show numbers, agents expose trajectories.

This isn't about replacing your finance team—it's about amplifying their capabilities 100-fold. Where a CFO sees monthly variances, financial agents reveal causality chains. Where spreadsheets show numbers, agents expose trajectories.

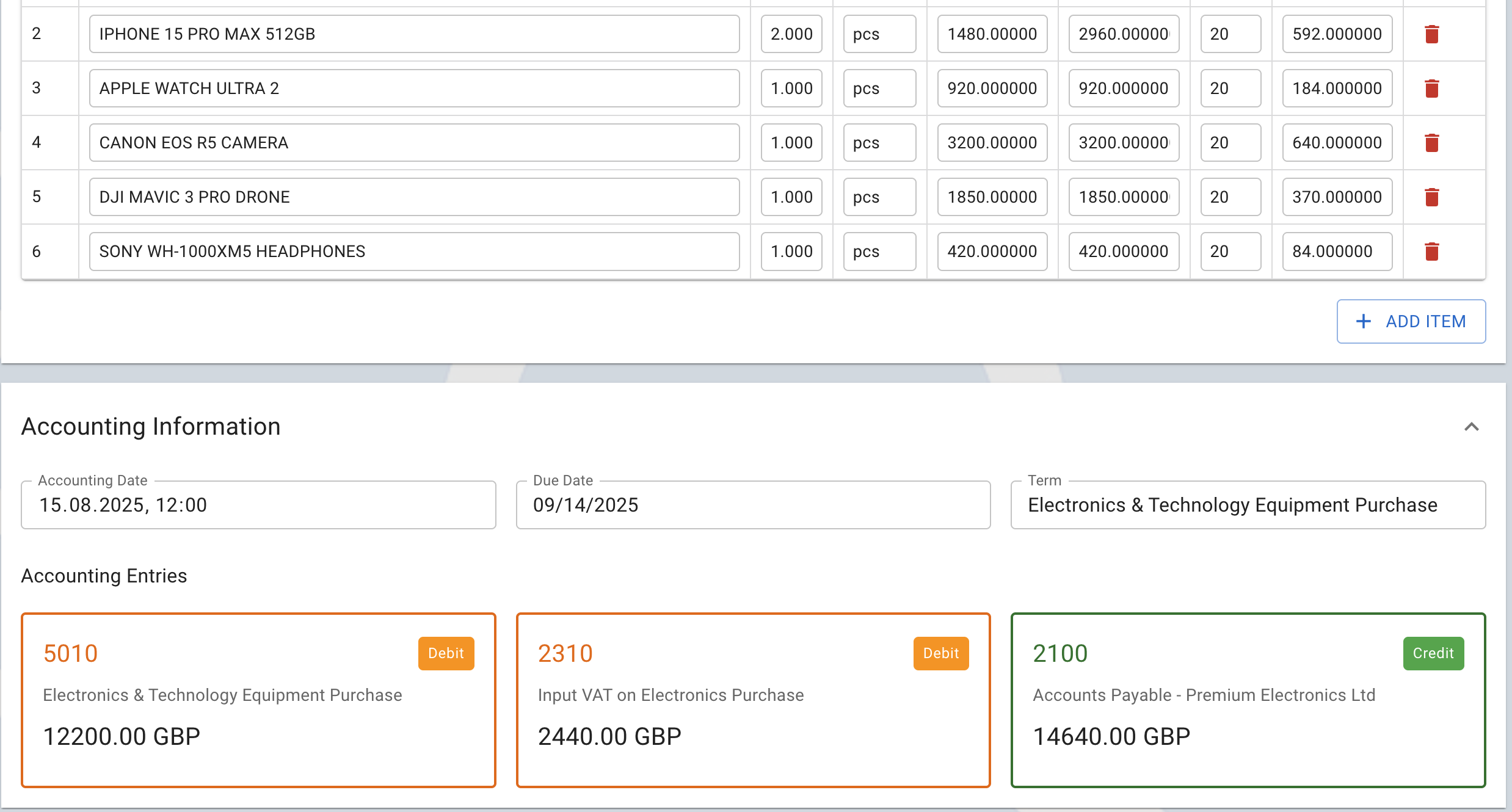

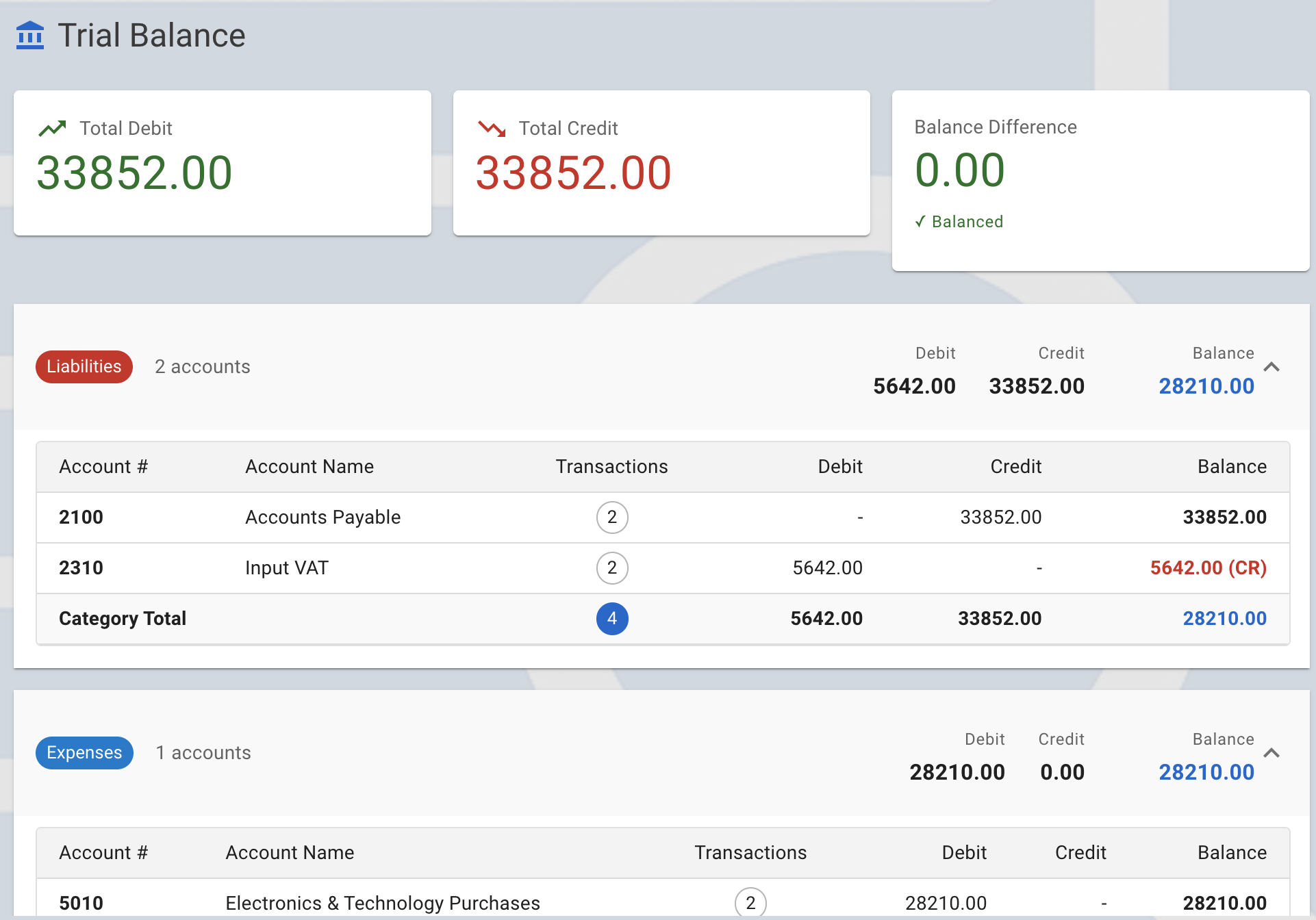

Achieving 99.7% Accuracy Through Dual Validation

Financial agents achieve 99.7% extraction accuracy through parallel processing—LLM vision understands context and relationships while OCR enforcement ensures numerical precision. This dual-validation approach eliminates transposed digits, misread amounts, and context errors that plague single-method systems.

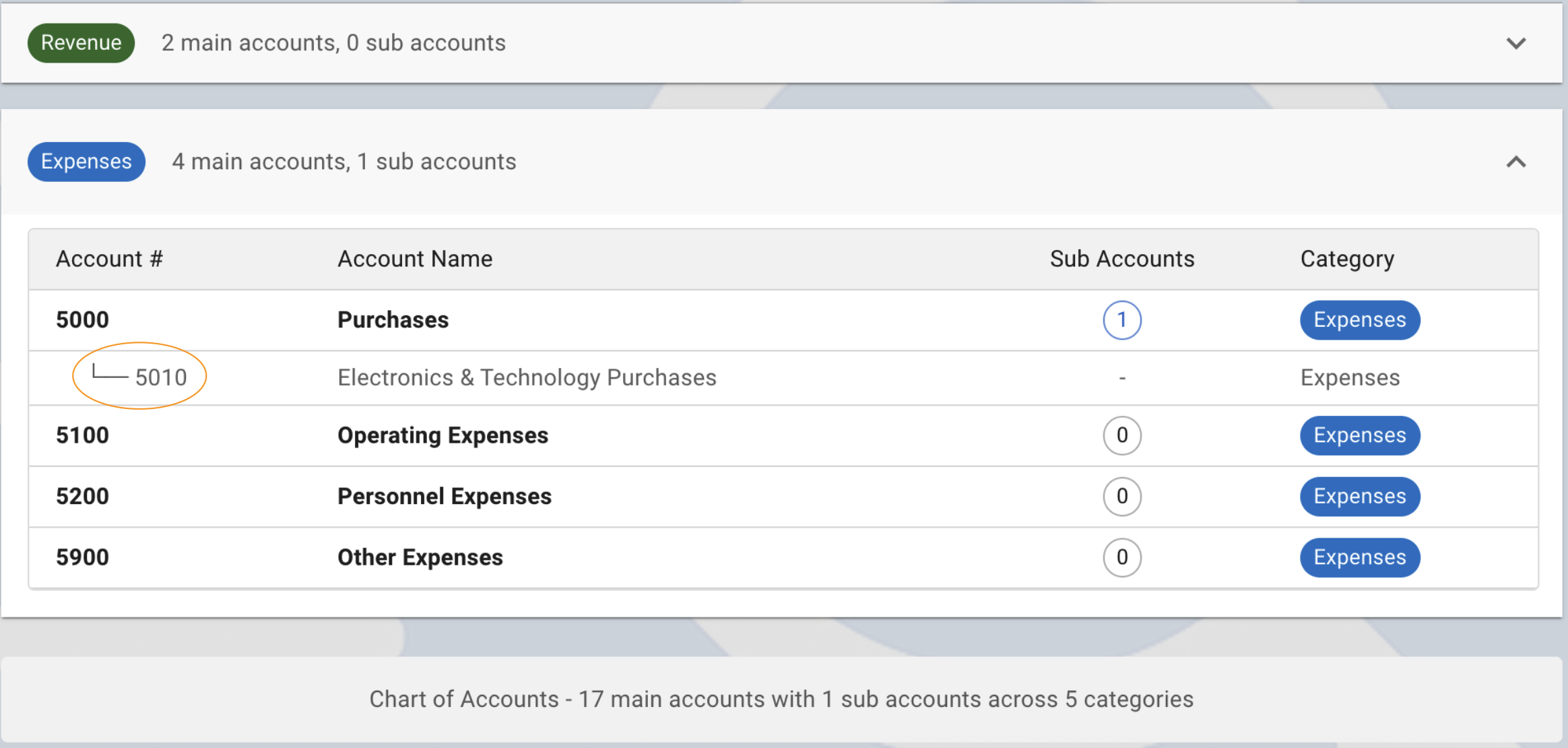

The agent autonomously evolves your accounting structure, creating new categories as your business grows, maintaining perfect double-entry bookkeeping without manual configuration.

The agent autonomously evolves your accounting structure, creating new categories as your business grows, maintaining perfect double-entry bookkeeping without manual configuration.

Natural Language Financial Queries

Transform complex financial analysis into simple conversations. Ask questions in plain language and receive instant insights: "Show me all vendors with pricing increases this quarter" or "Which departments have overlapping services?" The system understands context and delivers actionable intelligence in seconds.

Every query builds your institutional knowledge base, creating a compound intelligence effect that grows more valuable over time.

Every query builds your institutional knowledge base, creating a compound intelligence effect that grows more valuable over time.

Automated Workflows That Scale

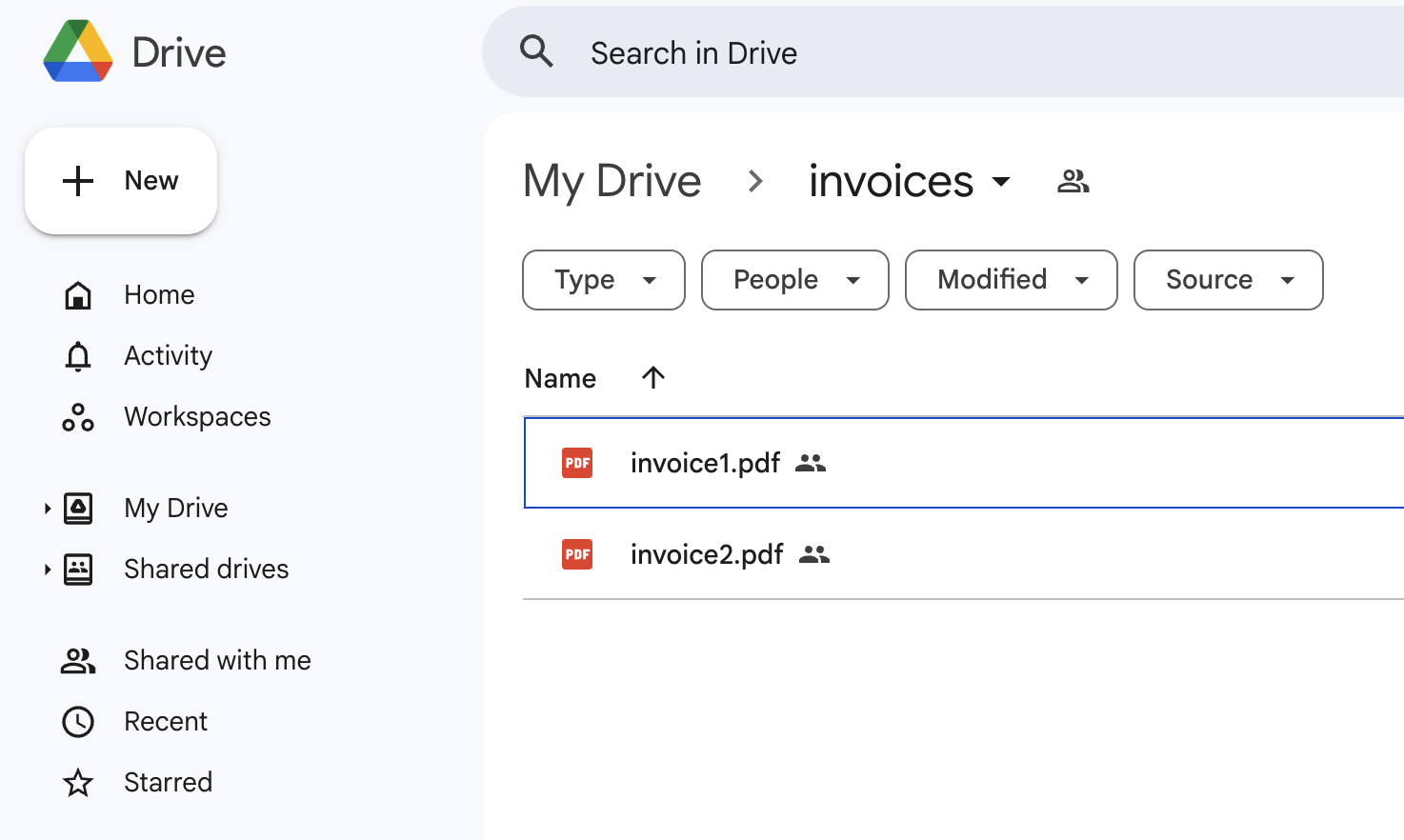

Connect your Google Drive, Dropbox, or email. Financial agents monitor for new invoices, process them automatically, and alert you to anomalies. No manual uploads, no data entry, no delays.

The system maintains complete audit trails, ensures compliance, and provides real-time visibility into your financial operations. Every transaction is tracked, every pattern analyzed, every opportunity surfaced.

The system maintains complete audit trails, ensures compliance, and provides real-time visibility into your financial operations. Every transaction is tracked, every pattern analyzed, every opportunity surfaced.

The Strategic Advantage

Modern CFOs don't need more dashboards. They need intelligence systems that detect pricing drift, predict vendor behavior, and identify redundancies before they compound. Financial agents represent a fundamental shift from data extraction to intelligence mining—revealing patterns and relationships that traditional systems cannot detect.

The difference between knowing your numbers and understanding your business.

The difference between knowing your numbers and understanding your business.

Technical Implementation

For developers interested in the technical implementation: View the complete API tutorial

For enterprise deployment and custom solutions, contact our team at office@openkbs.com

For enterprise deployment and custom solutions, contact our team at office@openkbs.com